Elder Law in Florida 2024

Florida Elder Law: A 2024 Comprehensive Guide As the population ages, understanding elder law becomes increasingly crucial. In Florida, where the senior community is a

Florida Elder Law: A 2024 Comprehensive Guide As the population ages, understanding elder law becomes increasingly crucial. In Florida, where the senior community is a

Contrasting Revocable and Irrevocable Trusts in New York Understanding Trusts in Estate planning Trusts are indispensable instruments in estate planning, offering strategies to manage

Trust and Will Attorneys in 2024: Navigating New Legal Landscapes in Estate Planning As we approach 2024, the landscape of estate planning continues to evolve,

Locating a Caring and Expert Probate Lawyer in New York (2025) Experiencing the loss of a loved one is never easy, and managing the intricacies

An administrative proceeding is a legal process overseen by an administrative agency or governmental body to resolve disputes, enforce regulations, or make decisions related to

Probate is the legal procedure that takes place just after the death of an individual. The process is where the validity of the decedent’s will

The father of Laken Riley is concerned that her tragic passing is being used as a divisive tool in the upcoming November election. The post

Understanding Probate Proceedings in New York: A Comprehensive Overview Coping with the loss of a family member or friend is a challenging period, and navigating

Navigating New York’s Estate Tax Landscape in 2025 As we approach the year 2025, residents of New York engaged in estate planning face a significant

Albany, NY: A 2025 Guide to Dental Practice Compliance with NYS Health Regulations The landscape of healthcare law is in constant flux, and for dental

New York Guardianship Proceedings Guardianship proceedings are crucial in protecting the rights and assets of incapacitated individuals. In many cases, an incapacitated person may fall

Top Reasons to Hire a Probate Attorney in New York The loss of a loved one brings immense grief, and the ensuing legal process of

Lawyers representing Hunter Biden had requested a judge to drop the nine charges related to taxes against him, claiming that political influence had a hand

Expert Estate Litigation in New York with Morgan Legal Group: Protecting Your Inheritance and Ensuring Justice is Served Estate litigation involves numerous challenges, particularly when

Introduction to Trusts and Wills Trusts and wills are crucial components of estate planning, serving distinct but complementary roles in managing and distributing an individual’s

Comprehensive Estate Litigation Services by Morgan Legal Group At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, guardianship, elder

Protecting Yourself from Unwanted Charges Dealing with unauthorized charges can be frustrating and financially burdensome, especially when they result from subscriptions or automatic renewals. To

Navigating Estate Administration with a Probate Lawyer in Long Island Coping with the loss of a loved one is a challenging and emotional time. The

The 7-Year Rule in Inheritance Tax: A Comprehensive Guide When planning your estate, understanding the nuances of inheritance tax and its implications is crucial. One

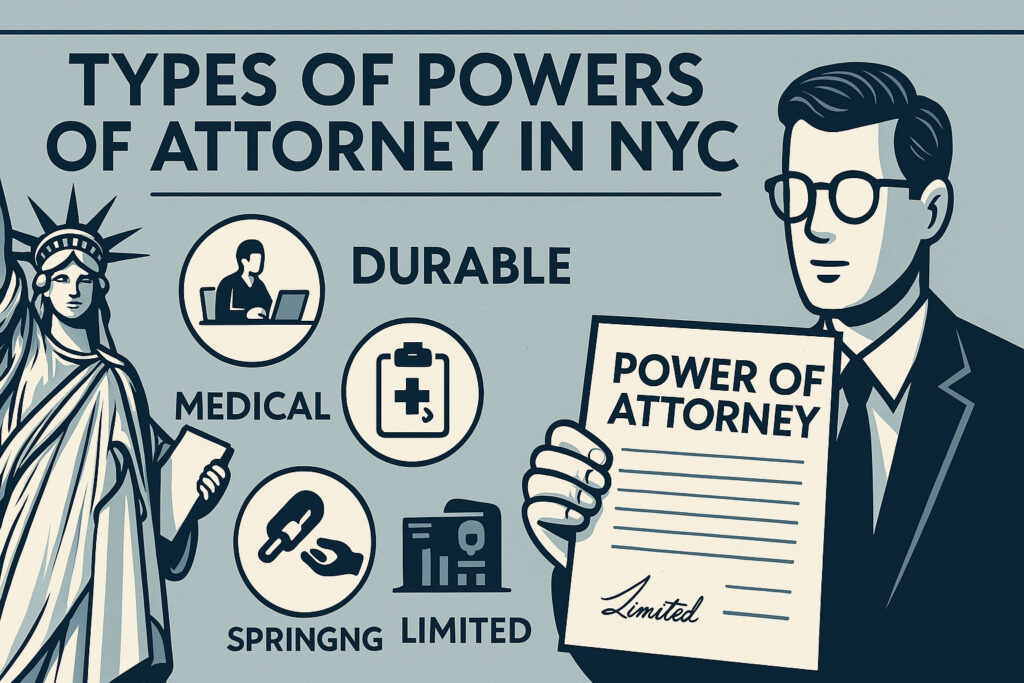

NYC Power of Attorney: A Complete Guide to Protecting Your Future In the bustling city of New York, planning for the unexpected is crucial. A

All About Wills and Trusts: Understanding Your Options for Estate Planning in New York Welcome to Morgan Legal Group P.C., your trusted partner for expert

The allure of South Florida is undeniable. From the gleaming high-rises of Sunny Isles to the family-friendly parks of Aventura and the strategic business hubs

Why You Need a Local 10016 Estate Planning Attorney The 10016 zip code is a dynamic and vital artery of Manhattan, pulsing with the energy

Why You Need a Local 10038 Estate Planning Attorney The 10038 zip code is the historic and financial epicenter of New York City. From the

Smart Gifting: Reducing Estate Taxes and Supporting Beneficiaries in New York At Morgan Legal Group, our seasoned estate planning attorneys recognise the significance of employing

Everybody owns some estate, which they want to get transferred to their loved ones after their death. The estate of the deceased gets transferred to

DIY Estate Planning vs. Hiring an Attorney in New York (2025): Weighing the Pros and Cons to Protect Your Future With the rise of online

The Importance of Updating Your Estate Plan in New York: Planning for 2025 and Beyond Estate planning is not a one-time event; it’s an ongoing

Plan Your NY Business Succession Today Business succession planning ensures a seamless transfer of ownership, safeguarding your company’s future. In New York, navigating legal, tax,

In this article, we will discuss another important topic closely associated with estate planning; power of attorney. You will get to know what exactly power

In the ever-evolving entertainment landscape, the intersection of technology and creativity has become a battleground for rights and recognition. The recent protests by video game

Navigating Dental Practice Purchase Agreements in Hallandale’s Competitive Market The dental industry in Hallandale, Florida, is experiencing a period of dynamic growth and transformation. As